nh meals tax form

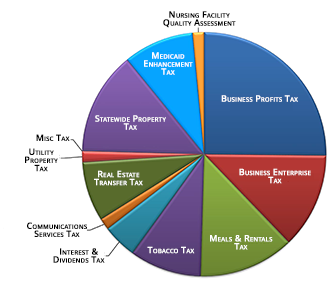

2 NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION MEALS RENTALS TAX BOOKLET GENERAL INFORMATION MR General Info Rev 122015 FORM MR General Information MR TAX LICENSE REQUIREMENT The MR Tax is a tax assessed upon patrons of hotels restaurants and renters of motor vehicles based on the. This new system will replace our current e-file system for Real Estate Transfer Tax counties DP-4 payments as of January 1 2022.

Incorporate In New Hampshire Do Business The Right Way

We last updated the 2013 Meals and Rentals Booklet in April 2021 and the latest form we have available is for tax year 2020.

. That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party platters. NH DRA PO Box 454 Concord NH 03302-0454. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

Select the document you want to sign and click Upload. The notice of tax means the date the board of tax and land appeals BTLA determines the. File this application with the municipality by the deadline see below.

Filing options - Granite Tax Connect. If you have a substantive question or need assistance completing a form please contact Taxpayer Services at 603 230-5920. Date of filing is the date this form is either hand delivered to the municipality postmarked by the post office or receipted by an overnight delivery service.

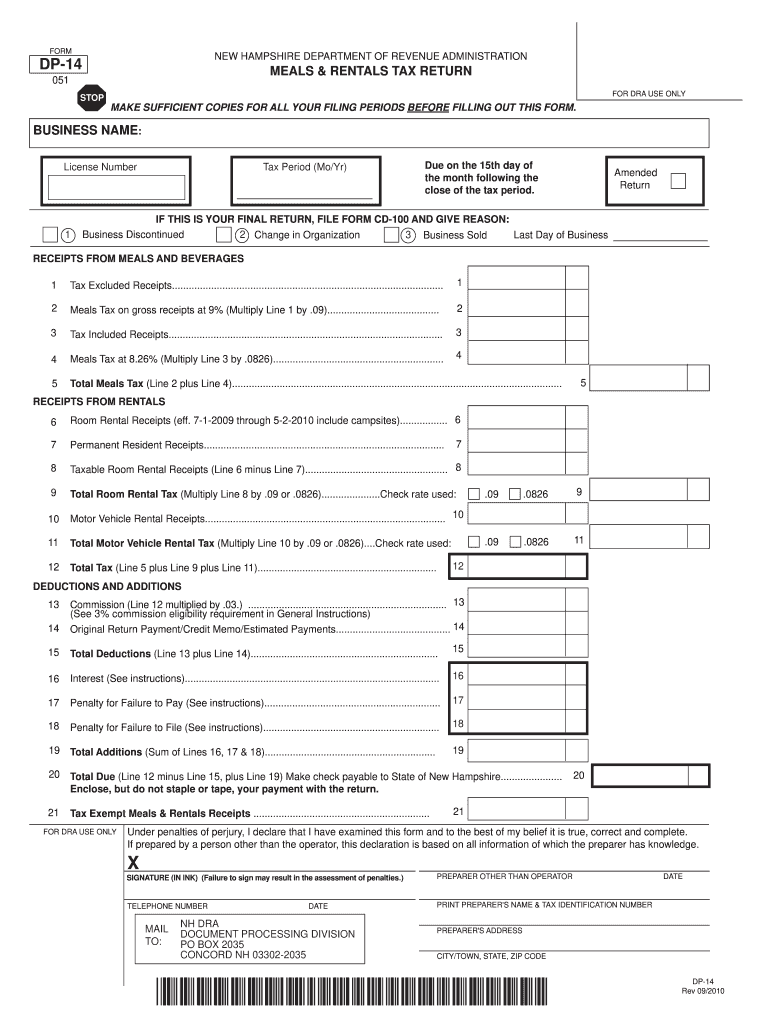

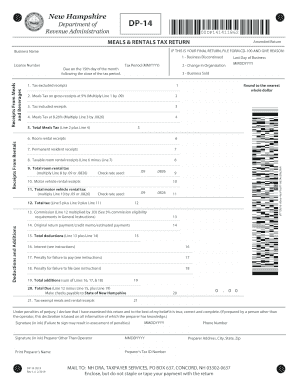

CHECK the AMENDED RETURN box if you are filing to make changes or corrections to a previously filed DP-14 for any ONE taxable period. After that your nh meals and rooms tax form is ready. TOTAL TAX DUE - The total of lines 11 and 12 is the total tax due to the State of NH.

Line 8 multiplied by 09 or 0826 if tax included. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. Tax Excluded Receipts Meals Tax 8 Line 1 multiplied by 08 Meals Tax 741 Line 3 multiplied by 0741 TOTAL MEALS TAX Line 2 plus Line 4 RECEIPTS FROM RENTALS Motor Vehicle Rental Receipts TOTAL TAX Line 5 plus Line 9 plus Line 11 Permanent Resident Receipts Room Rental Receipts Check rate used.

A typed drawn or uploaded signature. Download or print the 2021 New Hampshire 2013 Meals and Rentals Booklet 2021 and other income tax forms from the New Hampshire Department of Revenue Administration. Follow the step-by-step instructions below to eSign your nh dp14.

A 9 tax is also assessed on motor vehicle rentals. To request forms please email formsdranhgov or call the Forms Line at 603 230-5001. WHERE TO FILE Mail to.

File this form at least 30-days prior to the start of business or the expiration date of the existing license. What is the Meals and Rooms Rentals Tax. Payment on your FUTA form Line 13.

The tax applies to any room rentals for less than 185 consecutive days and to function rooms in any facility that also offers sleeping accommodations. This means that we dont yet have the updated form for the current tax yearPlease check this page regularly as we will post the updated form as soon as it is released by the New Hampshire Department of Revenue Administration. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more.

ACFR Reports by Fiscal year. As such New Hampshire Interest Dividends and Business Tax Business Profits Tax and Business Enterprise Tax returns that are due on Friday April 15 2022 will be due on Monday April 18 2022. Tax Returns Payments to be Filed.

File this form at least 30-days prior to the start of business or the expiration date of the existing license. Rentals Tax and follow the prompts. The Current Use Board is proposing to readopt with Amendment Cub 30503 Cub 30504 -Assessment Ranges for Forest Land Categories With and Without.

Line 8 multiplied by 08 or 0741 if tax included. Utility Property Tax. If you have questions call 603 230-5920.

Create your eSignature and click Ok. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. File and pay your Meals Rentals Tax online at GRANITE TAX CONNECT.

State of New Hampshire ACFR. A New Hampshire Meals Rentals Tax License must be obtained prior to the start of business and renewed by June 30 of each odd-numbered year. A New Hampshire Meals Rentals Tax License must be obtained prior to the start of business and renewed by June 30 of each odd-numbered year.

Be sure to visit our website at revenuenhgovGTC to create your account access today. MEALS RENTALS TAX RETURN Instructions Meals Rental Operators may file electronically on the Departments website at wwwrevenuenhgovgtc. 603 230-5920 109 Pleasant Street Medical Surgical Building Concord NH 03301.

Treasury Meals Rooms Tax Distribution Reports. Please visit GRANITE TAX CONNECT to create or access your existing account. Decide on what kind of eSignature to create.

Example line 10 Taxable wages 1400000 line 11 X UI Tax Rate 35 49000 line 12 X AC Tax Rate 02 2800 line 13 TOTAL TAX DUE 51800 if under 100 no payment due Line 14. Meals Tax 9 Line 1 multiplied by 09 Meals Tax 826 Line 3 multiplied by 0826 TOTAL MEALS TAX Line 2 plus Line 4 RECEIPTS FROM RENTALS Motor Vehicle Rental Receipts TOTAL TAX Line 5 plus Line 9 plus Line 11 Permanent Resident Receipts Room Rental Receipts campsites Check rate used. For additional assistance please call the Department of Revenue Administration at 603 230-5920.

NH DRA PO Box 454 Concord NH 03302-0454. Monthly Revenue Focus Unrestricted Revenue Report LBA Audit Findings. Forms publications reports and other documents issued by the State Treasury.

State of NH Unrestricted Revenue Reports. There are three variants.

Hoss And Mary S In Maine Makes Incredible Burgers The Incredibles Maine Mary

2010 Form Nh Dor Dp 14 Fill Online Printable Fillable Blank Pdffiller

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Surprising Data Reveals The Top 25 Tax Friendly States To Retire Retirement Tax States

Big Companies Landed Paycheck Protection Program Loans And They Ll Be Back For More Shake Shack Shake Shack Burger Shack Burger

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

Get And Sign Nh Dor 2019 2022 Form

New Hampshire Meals And Rooms Tax Rate Cut Begins

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Revenue Dept Launches Final Phase Of Tax System

Right To Know New Hampshire Attorney General Nh Gov